Combination of Garrison Investment Group & Blue Casa Telephone Along With the Existing TNCI Operations Will Create a Robust Network Platform Capable of Growth and Future Acquisitions SANTA BARBARA, CA – Jun 26, 2013 – TNCI Operating Company LLC, an entity formed by Garrison Investment Group (“Garrison”) and Blue Casa Telephone, acquired the assets of […] Read more

Deal Closings

Firm Closes Senior Term Loan and Revolving Line of Credit for Nationwide Facilities Maintenance Firm McLean, Virginia – March 31, 2013 – Backbone Capital Advisors, LLC (Backbone Capital) arranged the closing of a $4.4 million senior secured credit facility for its client Pristine Environments, Inc. (PEI), headquartered in McLean, Virginia. PEI, which has operations nationwide, […] Read more

Texas – January, 2013 – Backbone Capital supported acquisition financing of a retail consumer products company with retail stores throughout the United States. First lien and second lien credit facilities of $39M total were arranged for by a major NY hedge fund, and Backbone Capital brought in 2 investors to fill 1/3 of the total facilities.

Seattle, WA September, 2012 – Backbone Capital assisted a major Private Equity fund located in Los Angeles to acquire this enterprise software target. This company, specializing in software enhancing wireless mobile connectivity, was a divisional carve out from its parent company. Backbone Capital provided multiple term sheets to ensure the most cost effective and optimum […] Read more

Georgia – June, 2012 – Backbone Capital Advisors, LLC worked with a private equity fund to finance and recapitalize this apparel manufacturer undergoing operational restructuring.

Firm Closes Senior Debt Facility for OpenGate Capital Portfolio Company Los Angeles, CA – January 15, 2012 – Backbone Capital Advisors, a corporate finance firm focused on the middle-market, today announced the successful closing of a senior debt financing for TV Guide Magazine, an OpenGate Capital portfolio company. Britt Terrell, managing director of Backbone Capital, […] Read more

Los Angeles, CA – January, 2012 — Backbone Capital, under an incredibly tight time-frame, was able to successfully go to market, complete diligence and close this deal in 30 days.

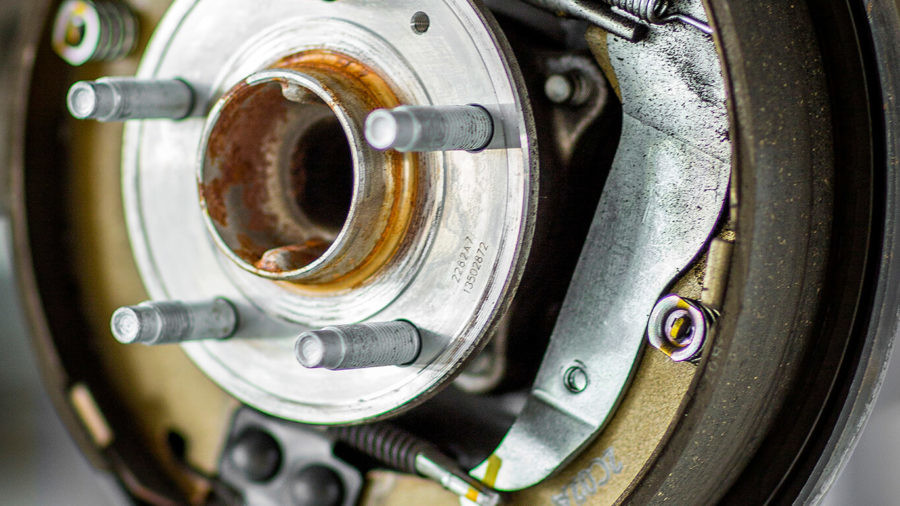

Illinois – May, 2011 — Backbone Capital assisted with this $8MM acquisition financing to allow an independent sponsor to acquire this designer and manufacturer of after market automotive products.

New York – May, 2011 – Assisted a major hedge fund in a very challenging credit facility closing by bringing in participants into the total credit facility. In Q3 2013, the agent is upsizing the credit facility for a change of control transaction, with majority of the original lenders rolling into the revised credit facility.